Insurance.alvatiha.com review

Kworld Trend / Insurance.alvatiha.com review

Get the Best Car Insurance with 05 Tips | Insurance.alvatiha.com review

Get the best car insurance with 05 tips. With the huge number of insurance providers and insurance policies available in the United States. It is necessary to navigate through the options to secure the best car insurance quotes that work for you. your needs and budget.

Whether you’re a new driver or looking to switch insurance companies, understanding the factors that affect premiums and using effective strategies can help you save money while getting comprehensive coverage.

In this article we will give you five invaluable empowerment tips. In your quest for the best US auto insurance quotes. Make an informed decision that protects your car and your money. Insurance.alvatiha.com review

Compare quotes from multiple insurance providers

a. Explain the importance of comparing citations

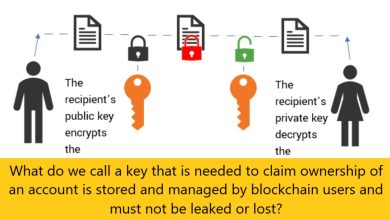

Comparing quotes from several insurance companies is a crucial step in finding the best auto insurance rates in the United States. Each insurance company evaluates various factors differently when determining premiums. As a result, insurance rates can vary widely between different providers for the same coverage. By comparing rates, you can gain insight into the range of rates available in the market, allowing you to make an informed decision and potentially save a significant amount of money on your auto insurance premiums.

B. Provide step-by-step instructions on how to obtain and compare quotes from different service providers:

1. Find insurance providers

Look for companies with good customer reviews, financial stability, and a track record of excellent customer service.

2. Gather the necessary information

Gather relevant information required to obtain accurate quotes, such as driver’s license number, vehicle details (make, model, and year), and current insurance policy (if applicable).

3. Contacting insurance service providers

Contact many insurance providers either by phone or through their websites. Provide them with the necessary information and request a quote for the desired coverage.

4. Use online comparison tools

Take advantage of online insurance comparison websites or tools that allow you to enter your details once and receive quotes from multiple providers simultaneously.

5. Review and compare prices

Once you have quotes from different providers, carefully review and compare coverage options, discounts, limits, and any additional features or discounts offered.

c. Highlighting the benefits of price comparison and finding the most competitive prices

1. Cost savings

By comparing rates, you increase your chances of finding the most competitive rates and potentially saving a significant amount of money on your auto insurance premiums.

2. Custom coverage

Comparing prices allows you to choose the policy that best suits your specific needs, ensuring that you get the right level of protection for your vehicle.

3. Quality of service

Besides competitive pricing, a price comparison gives you insight into the reputation and customer service standards of different insurance providers. It enables you to choose a company that not only offers attractive pricing but also excellent customer support when needed.

4. Peace of mind

By comparing rates and choosing a reliable insurance company, you gain peace of mind knowing that you made an informed decision and secured reliable coverage for your car.

Top 5 auto insurance companies in the USA

1. Endurance

Endurance is an insurance company that specializes in extended auto warranty plans. It offers five different coverage options for mechanical breakdowns, making it suitable for older vehicles up to 20 years old. With Endurance, customers can choose any ASE-certified mechanic or dealer for repairs, and they just have to pay the deductible. All plans come with 24/7 roadside assistance, rental car reimbursement, and a one-year endurance benefit subscription for routine maintenance. Policy terms can extend up to 6 years or 100,000 miles, and monthly payment plans are available. It also provides endurance. 30-day money-back guarantee. However, there is a 60-day waiting period for most plans, and rental car reimbursement has limitations. Overall, Endurance offers comprehensive coverage and flexibility for older vehicles.

2. Vehicle shield

CarShield is an insurance company that offers a range of vehicle warranty solutions. Their coverage options include basic drivetrain and engine protection as well as comprehensive coverage for both cars and motorcycles/ATVs. With annual premiums starting at $1,200, CarShield offers competitive pricing in the market.

One notable feature of CarShield is the Roadside Protection Package, which offers additional assistance in the event of a breakdown or emergency. In addition, CarShield is known for offering customized policies, allowing customers to tailor their coverage to their specific needs.

While CarShield received mixed reviews online. It is important to note that many negative. The reviews seem to stem from a lack of understanding of the policy rather than issues with the company itself. Despite this, CarShield remains a good option for car warranty coverage, and its competitive pricing and diverse coverage options make it worth considering.

Positives:

- It provides coverage for motorcycles and ATVs

- Provides policies tailored to individual needs

- competitive prices

cons:

- Phone prompts are only available during business hours, and 24/7 support is lacking

- Some mixed reviews from previous customers

3. CARCHEX

CARCHEX is an extended auto warranty broker known for offering a wide range of insurance policies from several insurance providers. With annual installments ranging from $200 to $750. The company provides coverage terms of up to 10 years. They offer 24/7 roadside assistance, towing, and car rental refunds with all of their policies. Karchiks. It allows you to pay your plan in installments up to 24 months. It offers a 30-day money-back guarantee. They are accredited by the Better Business Bureau with an A+ rating and have the flexibility to move or cancel your plan for a prorated refund. While they charge a fee to transfer policies, it is important to note that CARCHEX does not directly administer the policies themselves.

4. The American Dream

American Dream Auto Protect is an insurance company that believes in providing car owners with accessible warranties to protect them from unexpected auto repairs. They offer coverage for cars manufactured in 2000 or later, and customers can choose from three different plan options.

The company prides itself on providing a superior customer experience. Round-the-clock access to customer service is guaranteed. One of the benefits of purchasing a warranty from American Dream Auto Protect is that 24/7 roadside assistance is included with all plan levels.

However, it should be noted that the company only offers three plan options. Customers are required to either call or fill out a form to obtain pricing information. Insurance.alvatiha.com review

5. Select Auto Protect

Select Auto Protect is an insurance company that specializes in extended vehicle warranty policies. Their coverage options protect against engine damage and mechanical failure, providing customers with financial security and peace of mind. The company stands out by offering a direct payment system for repair bills, allowing customers to take their cars to any ASE-certified mechanic without having to pay out of pocket.

With three plans available, customers can choose the level of coverage that best fits their budget, all of which include a $100 deductible. While there is a 30-day waiting period for coverage to take effect, comprehensive protection and a convenient payment process make Select Auto Protect a reliable choice for your extended vehicle warranty needs. To obtain a quote, clients must contact the company directly, ensuring personal assistance and accurate pricing tailored to their specific requirements.

Conclusion

Getting the best US auto insurance quotes involves comparing quotes from multiple providers, understanding personal coverage needs, maintaining a good driving record, exploring policy bundling options, and researching additional discounts. Select Auto Protect specializes in vehicle extended warranty policies, offering direct payment of repair bills and a range of coverage plans.

While there is a waiting period for coverage to take effect, Select Auto Protect offers comprehensive protection. By following these tips and considering Select Auto Protect, individuals can make informed decisions to secure the best auto insurance coverage and rates. Insurance.alvatiha.com review