Hot own loan interest rates for lovers in 2025

Kworld Trend / Hot own loan interest rates for lovers, In the year 2025, the lending landscape is presenting couples with an incredible opportunity to achieve their dreams together.

Financial institutions are offering attractive interest rates tailored specifically for couples. These rates are designed to empower couples to embark on journeys like never before, whether it’s buying a first home, planning a memorable wedding, or going on that dream vacation.

Hot own loan interest rates for lovers in 2025

Lenders understand the unique aspirations that couples share. That’s why they’ve introduced special loan interest rates to assist couples in turning their joint dreams into reality. These rates are structured to make borrowing more affordable and manageable, easing the path towards building a life together.

Imagine walking hand in hand into your dream home, knowing that you’ve secured a home loan at an interest rate that won’t burden your pockets.

Or picturing yourselves saying “I do” at the wedding you’ve always envisioned, without worrying about excessive interest payments. With the right loan, couples can now invest more in creating memories and nurturing their relationship.

The process of obtaining these special couple-centric interest rates is straightforward. Lenders analyze the combined financial strength of both individuals, taking into account their credit scores and shared income. This holistic approach often results in more favorable terms, enabling couples to access funds at rates that reflect their commitment to each other.

Hot own loan interest rates for lovers

Before diving into the world of loans, it’s essential for couples to explore their options thoroughly.

Different financial institutions might offer varying rates and terms, so it’s wise to shop around and compare offers. Additionally, couples should have open and honest conversations about their financial goals, making sure that any loan aligns with their joint vision.

As couples plan their future, they can take advantage of these hot interest rates to make their dreams come true.

By securing a loan that caters to their unique needs, couples can focus on what truly matters: building a life filled with love, shared experiences, and cherished moments. So why wait? Explore the possibilities, find the perfect loan, and step into a future illuminated by your shared aspirations.

Why Loan Interest Rates Matter to Couples

For couples in love, dreams and aspirations often require ¦nancial backing. From engagement rings to honeymoon destinations, the costs can add up. Taking out a loan might be a practical solution, but understanding the interest rates is crucial. It’s not just about borrowing money; it’s about making informed decisions that won’t strain the relationship down the road.

Love and Money: A Delicate Balance

For couples deeply in love, dreams and aspirations are a beautiful part of the journey. Whether it’s buying the perfect engagement ring to symbolize eternal commitment or planning a magical honeymoon to celebrate the beginning of married life, these dreams often come with a price tag. From the sparkle of diamonds to the allure of unfamiliar destinations, the costs can quickly add up, leaving couples wondering how to nance these special moments.

The Role of Loans in Love

That’s where loans come into the picture. For many couples, taking out a loan might seem like a practical solution to make these dreams come true. Want to propose under the Eiffel Tower? A travel loan can get you there. Dreaming of a fairytale wedding in a castle? A personal loan might make it possible. Loans provide the ¦nancial backing to turn dreams into reality.

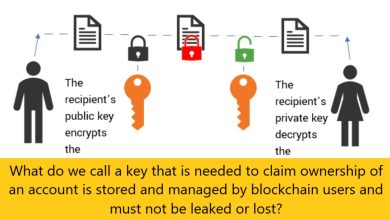

Understanding Interest Rates: More Than Just Numbers

However, loans are not just about borrowing money. They come with something called interest rates, which is the extra money you pay back to the lender on top of the amount you borrowed. Think of it like a fee for using someone else’s money for a while. Understanding these interest rates is crucial for couples. Why? Because different loans have different interest rates, and choosing the wrong one can make the loan much more expensive in the long run. It’s like choosing between two beautiful roses, one that stays fresh for a week and

another that withers overnight. You’d want to pick the one that gives you the best value and joy.

Informed Decisions: Protecting Love and Finances

Making informed decisions about loans and interest rates isn’t just about saving money; it’s about protecting the relationship. Money matters can strain even the strongest bonds if not handled with care and understanding. Imagine the stress and tension if a loan becomes a burden rather than a blessing. That’s why it’s essential to talk openly, compare options, and choose a loan that ¦ts the couple’s budget and needs.

Interest rates hit highest level in over 20 years

On Wednesday, July 26, the Federal Reserve raised the key interest rate by 0.25 percent, bringing the average personal loan rate to a whopping 11.27 percent. Not only is this the highest rate the consumer lending industry has seen in an upwards 20 years, but it is the 11th hike in its last 12 meetings.