Canara Bank offers a range of home loan options to meet the diverse needs of its customers. From Canara Housing Loan to Canara Home Loan Plus, there is a loan option available for everyone. In this article, we will take a look at the different loan options, their interest rates, and the repayment options available to borrowers.

Canara Bank Home Loan Schemes

Canara Bank has several home loan schemes to choose from. The options available are:

- Canara Housing Loan

- Canara Site Loan

- Canara Home Loan Plus

- Home Improvement Loan

Canara Housing Loan

- Interest rate: 8.55% p.a. to 13.35% p.a.

- Processing fee: 0.50% (min. Rs.1,500 and max. Rs.10,000)

- Repayment tenure: up to 10 years

- This loan is for the purchase of sites sold by the State/Central governments, Town Planning departments, or any authorized government organization.

Canara Site Loan

- Interest rate: 9.85% to 10.90% p.a.

- Processing fee: 0.50% (min. Rs.1,500 and max. Rs.10,000)

- Repayment tenure: up to 10 years

- This loan is specifically for the purchase of sites sold by the State/Central governments, Town Planning departments, or any authorized government organization.

Canara Home Loan Plus

- Interest rate: 9.35% p.a. to 11.40% p.a.

- Processing fee: NA

- Repayment tenure: Term loan of up to 10 years or overdraft of up to 3 years

- This loan is an additional amount on an existing housing loan from the bank and is only available to borrowers with a good repayment history for at least 1 year.

Home Improvement Loan

- Interest rate: 11.30% p.a. to 13.35% p.a.

- Processing fee: 0.50% (min. Rs.1,500 and max. Rs.10,000)

- Repayment tenure: up to five years

- This loan is for the purchase of household appliances and the furnishing of the house. It is also available for Non-Residential Indians (NRIs).

Canara Mortgage

- Interest rate: 10.30% p.a. to 12.35% p.a. onwards

- Processing fee: 0.50% (min. Rs.5,000)

- Repayment tenure: up to 10 years

- This loan is for individuals for non-business purposes only to meet immediate financial needs.

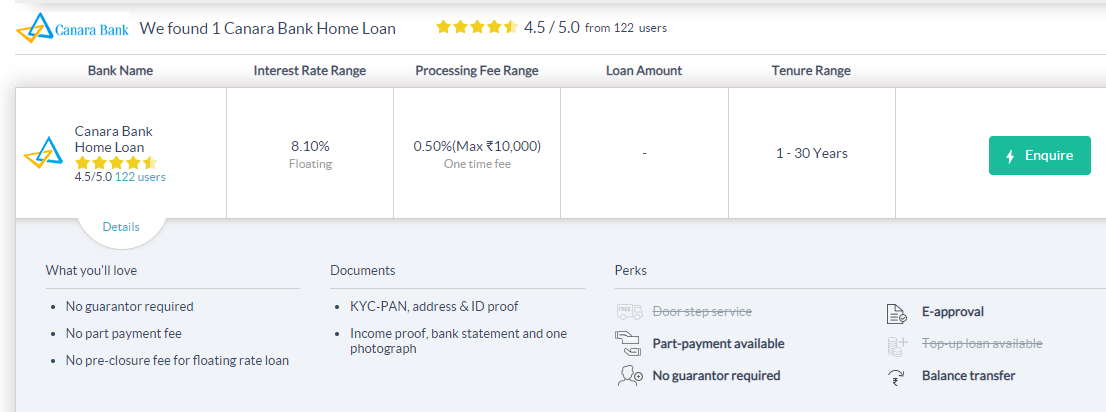

Canara Bank Home Loan Eligibility Criteria

- Minimum age of the applicant: 21 years

- Maximum age of the applicant: 70 years

- Residency status: Residents of India/Non-residents of India (depending on the scheme chosen)

- Type of employment: Salaried/Self-employed/Businessmen/Professionals

Documents Required for Canara Bank Home Loan

When applying for a Canara Bank home loan, you will need to submit the following documents:

- Identity proof (any one): Valid passport, PAN card, Driving license, Voter’s ID, Aadhaar Card

- Address proof (any one): Aadhaar Card, PAN Card, Copy of utility bills, Voter’s ID, Driving license, Valid passport

- Income proof (any one):

- For salaried individuals, the minimum net monthly income should be Rs.15,000, while the minimum net income for self-employed individuals should be Rs.2.40 lakhs p.a. Additionally, the applicant must have a minimum of 3 years of work experience and be a permanent employee.

Repayment Options for Canara Bank Home Loan

Canara Bank offers flexible repayment options for home loan borrowers. You can choose from the following options:

- Equated Monthly Installments (EMIs)

- Overdraft facility

- Loan against property

- Flexi Interest-only Home Loan

- Flexi Loan (Term Loan + Overdraft)

EMIs are calculated based on the loan amount, interest rate, and loan tenure. Using the Canara Bank Home Loan EMI Calculator, you can calculate your monthly repayment amount and plan your finances accordingly.

Home Loan Insurance with Canara Bank

Home loan insurance is a term insurance plan that offers coverage for the outstanding loan amount in the event of the death of the borrower. Canara Bank offers two types of home loan insurance plans:

- Canara Home Protection Plan

- Group Home Loan Protection Plan

The Canara Home Protection Plan is a term insurance plan that provides coverage for the outstanding loan amount in the event of the death of the borrower. The premium for this plan is based on the age of the borrower, loan amount, and interest rate.

The Group Home Loan Protection Plan is a group insurance plan for home loan borrowers that provides coverage for the outstanding loan amount in the event of the death of the borrower. The premium for this plan is based on the age of the borrower, loan amount, and interest rate.

Home Loan Transfer to Canara Bank

If you have an existing home loan with another bank, you can transfer it to Canara Bank and avail the benefits of lower interest rates and flexible repayment options. Canara Bank offers the following services for home loan transfer:

- Balance Transfer of Home Loan

- Top-up Loan

- Home Extension Loan

- Home Conversion Loan

Before transferring your home loan, it is important to compare the interest rates, processing fees, and other charges offered by different banks. You can use the Canara Bank Home Loan EMI Calculator to compare the monthly repayment amounts and choose the best option for you.

In conclusion, Canara Bank offers a range of home loan options to meet the diverse needs of its customers. From low interest rates to flexible repayment options, Canara Bank makes it easy for you to finance your dream home. Whether you’re a first-time homebuyer or looking to transfer your existing home loan, Canara Bank has a solution for you.

People are also interested in: Qantas money home loans