Borrow usdt without collateral

Kworld Trend / Borrow usdt without collateral Looking to borrow usdt without collateral? The world of cryptocurrency can be complicated, but don’t worry – we’ve got you covered.

Cryptocurrency Loans and How They Work | Borrow US dollars without collateral

Cryptocurrency loans are a form of financial service that uses blockchain technology to facilitate the lending and borrowing of digital assets. However, Crypto loans allow borrowers to access funds without the need for a traditional financial intermediary. Loans typically originate from decentralized applications (dApps) on a blockchain network where borrowers and lenders can securely and transparently negotiate loan terms and conditions.

Unlike traditional lending models, cryptocurrency loans are borderless and require no credit checks. Anyone with a crypto wallet can instantly use these protocols and gain access to financial services. Cryptocurrency loans allow more flexibility regarding repayment schedules and loan amounts.

Why do cryptocurrency loans require collateral?

In most cases, the loan is collateralized with cryptocurrency or other digital assets, allowing the lender to get their money back in the event that the borrower defaults on their loan payments. Loan terms are often programmed into the dApp, which means the borrower can rest assured that all terms and conditions of their loan will be respected.

Most protocols choose the redundancy scheme to ensure safety. The cryptocurrency used as collateral is a form of collateral for the loan, ensuring that the lender will be repaid in the event that the borrower defaults on the loan. This includes setting a loan-to-value (LTV) ratio, which requires that the borrower provide more collateral than is necessary to cover the loan amount. This is important for both the borrower’s attitude and the integrity of the overall protocol, as it helps protect the lender from losses if the borrower defaults on their loan. Over collateral also helps reduce the impact of market volatility, as a higher LTV ratio can result in a larger potential loss to the lender if the value of the collateral declines during the life of the loan.

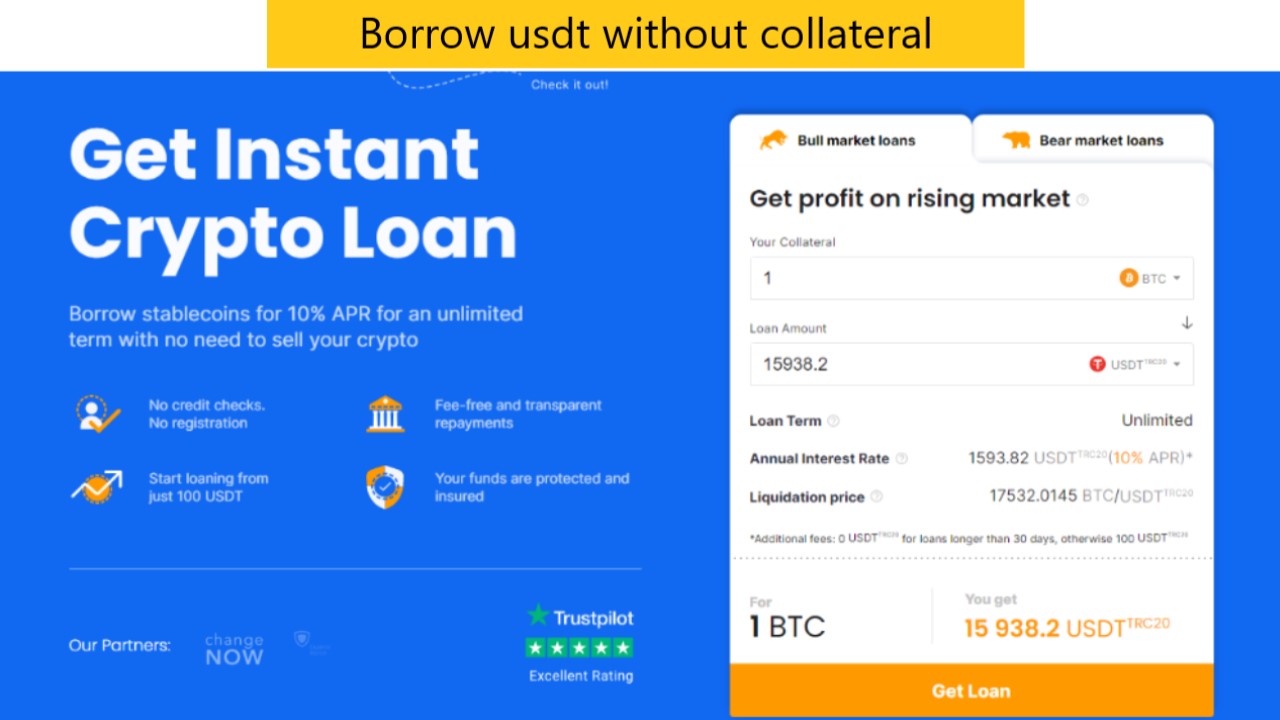

Platforms to borrow USDT without collateral

In this article, we will discuss the best platforms to borrow USDT without collateral.

First, let’s define what USDT is.

USDT, also known as Tether, is a type of stablecoin pegged to the value of the US dollar. This means that the value of USDT is designed to be stable, unlike other cryptocurrencies that can fluctuate wildly in value.

Now, let’s move on to the platforms.

Is it possible to get a crypto loan without collateral?

Key takeaway:

-

Unlike bank loans, you do not need a good credit score to get a crypto loan.

-

Cryptocurrency loan providers typically require users to pledge their crypto assets in order to obtain a loan.

-

Getting a crypto loan without collateral is very risky because the “crypto lenders” who offer off-the-shelf loans may be fraudulent entities who want to steal your assets or identity.

-

To prevent falling prey to scams, consider using a trusted crypto loan provider like Binance Loans.

Is it possible to borrow cryptocurrency without putting up your assets as collateral? There may be, but it is likely to be a scam. Collateral is usually used to protect cryptocurrency lenders, so loans that seem too good to be true, such as unsecured loans, are likely not true. Users are warned not to borrow cryptocurrency from “lenders” who do not need collateral.

Celsius Network

The peer-to-peer lending platform, Celsius Network, allows for collateral-free borrowing and lending of cryptocurrency. The platform offers loans from $500 at 1% annual interest and approval within 24 hours. Loans are paid in USDT, the loan term is flexible with no penalty fee for early repayment.

However, borrowing on the Celsius network is not without risk. The interest rate can change, and borrowers may have to provide collateral if the value of their crypto assets drops.

Nexo

Nexo, a blockchain-based lending platform, enables users to borrow

USDT without collateral. This makes it a suitable option for those seeking cryptocurrency loans. The platform offers loans starting at $10 and at an attractive interest rate of 6.9% per annum. One of the main benefits of Nexo is its fast approval process. Loans are approved within minutes and repaid in USDT, providing borrowers with much-needed liquidity.

The loan term on Nexo is also flexible, allowing borrowers to choose their own repayment schedule. They can even pay off the loan early without incurring any penalty fees. This level of flexibility gives borrowers more control over their loan repayments. Additionally, this makes it a suitable option for those looking for customizable loan terms.

However, it is important to note that borrowing on Nexo, like any lending platform, involves risks. The interest rate is subject to change. This means that borrowers need to carefully consider the potential impact on their loan payments if the rate were to rise. In addition, borrowers may be required to provide collateral in the event that the value of their crypto assets decreases. This may affect borrowing ability or result in additional security requirements.

BlockFi

BlockFi is a cryptocurrency lending platform that offers collateral-free USDT loans. Offers loans from $5,000 at an interest rate of 4.5% per annum. Loan approvals take 24 hours and funds are paid out in USDT. The term of the loan is flexible, allowing borrowers to repay at their convenience without incurring penalty fees.

However, it is crucial to consider the risks associated with borrowing on BlockFi. The rate of interest is variable and borrowers may need to provide additional collateral. This is done in the event that the value of their crypto assets decreases.

YouHodler

YouHodler is a lending platform that allows users to borrow USDT without collateral. The platform offers loans starting at $100 at 12% per annum. The platform approves loans within minutes and pays them in USDT. The term of the loan is flexible, and the borrowers can choose to repay the loan at any time without incurring any penalty fees.

However, it is important to note that borrowing from YouHodler carries risks. Lenders may change the interest rate. They may also require borrowers to provide additional collateral if the value of their crypto assets declines.

Unrestricted capital

Unchained Capital is a lending platform that allows users to borrow USDT without collateral. The platform offers loans starting at $10,000 at 12% per annum. Lenders approve loans within minutes and pay them in USDT. The term of the loan is flexible, and the borrowers can choose to repay the loan at any time without incurring any penalty fees.

However, it is important to note that borrowing on unrestricted capital comes with risks. Lenders can change the interest rate, and borrowers may need to provide more collateral if the value of their crypto assets drops.

Conclusion

In conclusion, borrowing USDT without collateral can be a convenient way to access funds quickly. However, it is important that you do your due diligence and thoroughly research each platform before making any decisions. It is also important to keep in mind the risks involved, such as the possibility of market volatility and the possibility of default on your loan.

Despite the risks, the platforms we mentioned in this article have built a solid reputation for providing a reliable and secure borrowing experience. Whether you are looking for flexibility or low interest rates, there is a platform out there for you.

Therefore, if you require quick access to USDT funds and are not willing to put collateral, the best platforms to borrow USDT without collateral are worth considering. But remember, always proceed with caution and only invest what you can afford to lose.