high risk merchant highriskpay.com review

High risk merchant highriskpay.com review:

Banks and credit card companies consider high-risk businesses to be those that engage in gambling, adult entertainment, travel, e-commerce, CBD, and other similar activities. These shippers face higher paces of chargebacks, extortion, and administrative issues, which make them less appealing to conventional installment processors.

High-risk Merchant Account

High-risk merchant account providers provide these kinds of businesses with competitive rates, features, and support. They specialize in serving these kinds of businesses. High Risk Pay, whose website is highriskpay.com, claims to provide high-risk merchant accounts and payment gateway solutions to businesses in all industries.

Read Also: feedopi.com site review

In this blog post, we’ll examine High Risk Pay and how it compares to other high-risk merchant account providers on the market.

Toward the finish of this post, you will have a superior thought of whether High Gamble Pay is the ideal decision for your high-risk business.

Pricing

When choosing a high-risk merchant account provider, pricing is one of the most important considerations. Because of the expanded gamble, high-risk organizations normally pay higher charges than okay organizations.

Starting at 1.79 percent, High Risk Pay asserts that its pricing for high-risk merchants is fair and transparent. This is an extremely low rate contrasted with other high-risk suppliers, who generally charge around 2.5% to 5% or more.

Be that as it may, this rate may not matter to all traders, as it relies upon different factors like your industry, volume, history, and financial assessment. You will need to get in touch with High Risk Pay for a quote because the company’s website does not disclose its complete pricing structure.

High Gamble Pay

High Gamble Pay additionally guarantees that it charges no arrangement expenses or application expenses for its high-risk shipper accounts.

This is a decent sign, as certain suppliers might charge hundreds or thousands of dollars for these expenses. In contrast, High Risk Pay charges a monthly fee of $49.95 for its payment gateway service, which is necessary for online transactions.

High Gamble Pay specifies no different expenses on its site, for example, exchange charges, articulation charges, chargeback charges, or end expenses.

These charges might in any case apply relying upon your agreement agreements. Therefore, before signing up with High Risk Pay, it is recommended that you carefully read your contract and inquire about any potential account fees.

Selecting a high-risk merchant account provider

When selecting a high-risk merchant account provider, features are an additional consideration. Features that can assist high-risk businesses in reducing their risk exposure and increasing sales conversions are essential. Tools for chargeback management, recurring billing options, support for multiple currencies, mobile payments, and other features are among these.

Some of these features are provided to high-risk merchants by High Risk Pay:

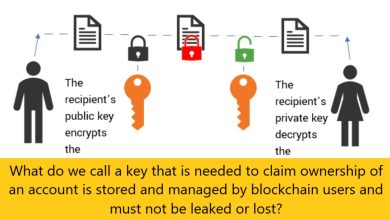

- It provides, for instance, IP address verification, the Address Verification Service (AVS), the Card Verification Value (CVV), and 3D Secure (Verified by Visa and Mastercard SecureCode) as fraud prevention tools.

- It provides chargeback representation services, real-time alerts, assistance with dispute resolution, and chargeback management tools.

- It provides options for recurring billing to businesses that are subscription-based or that provide installment plans or memberships.

- It supports multiple currencies for businesses that sell internationally or want to accept multiple currencies for payments.

- It offers versatile installments support for organizations that need to acknowledge installments in a hurry or through cell phones.

- High Gamble Pay doesn’t offer a few elements that other high-risk providers might offer, like virtual terminal access, Programming interface mix, shopping basket mix, or on the other hand adjustable checkout pages.

- These elements might be significant for a few high-risk providers who need greater adaptability what’s more, command over their installment handling experience. As a result, you might want to check with High Risk Pay to see if they can offer these features or if they can integrate with solutions from third parties that do.

The level of customer service offered by a high-risk merchant account provider should also be taken into consideration. When it comes to problems like declined transactions, high-risk businesses need customer service that is quick, knowledgeable, and helpful.