carefirst nationsbenefits com activate

CareFirst NationsBenefits.com Activate is a website for members of the CareFirst Nations Benefits program.

The website allows members to activate their CareFirst Nations Benefits account and access their personal health information, coverage details, and other important benefits information.

By activating their account, members can take advantage of the many resources available to them through CareFirst Nations Benefits, including online health tools and resources, access to healthcare providers, and the ability to view their claims history and manage their benefits.

By visiting CareFirst NationsBenefits.com Activate, members can ensure they are fully utilizing the benefits available to them through CareFirst Nations.

How does carefirst card work?

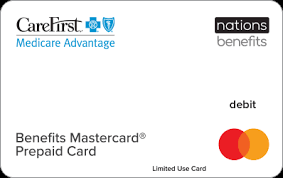

Carefirst card is a type of health insurance card that provides access to medical benefits and services.

It works by verifying the individual’s insurance coverage and eligibility when they present the card at a participating healthcare provider.

The healthcare provider then uses the information on the card to bill the insurance company for the services rendered.

The individual is responsible for paying any deductibles, copays or coinsurance as outlined in their insurance plan.

The carefirst card acts as proof of insurance coverage and helps streamline the billing and payment process for both the individual and the healthcare provider.

Read also: capitalbluecross.nationsbenefits.com Activate Card

How does the Over-the-Counter (OTC) and Flex healthcare prepaid benefit work with my health plan?

Over-the-Counter (OTC) and Flex healthcare prepaid benefits work as additional funds allocated by an employer or a healthcare plan for its members to spend on health-related items and services not covered under their traditional health insurance plan.

OTC benefits are typically used for purchasing items like pain relievers, cold medicine, vitamins, and first-aid supplies, while Flex healthcare prepaid benefits can be used for a wider range of health and wellness expenses, such as co-payments, deductibles, and copayments for doctor’s visits, dental care, vision care, and more.

These benefits complement traditional health insurance and allow individuals to have more control over their healthcare spending, giving them the flexibility to choose how and when to use their funds to best meet their healthcare needs.