Workers comp insurance unveiling the secrets to affordable coverage

Kworld Trend / Workers comp insurance unveiling the secrets to affordable coverage

Workers comp insurance unveiling the secrets to affordable coverage

Saving on Workers’ Compensation Insurance

Navigating the world of workers’ compensation insurance can be daunting, especially for small businesses with limited budgets. As much as you may want to try to wear multiple hats and manage workers’ comp in-house, it may be beneficial to partner with a payroll provider who knows the ins and outs of workers’ compensation.

The right partner can connect you with insurance brokers who can save your company thousands of dollars in the long run.

ConnectPay works with small business owners every day. Our approach partners you with insurance brokers who are able to obtain competitive quotes tailored to your specific needs. These brokers understand the complexities of workers’ compensation insurance and have experience negotiating rates that can benefit your business.

You want affordable workers’ compensation insurance…but you know you can’t compromise on quality. To achieve this, you should explore strategies that help you improve your workers’ comp costs!

Don’t let workers’ compensation insurance payments stress you out! Contact us today, and let us help you find affordable solutions that protect your employees and your bottom line.

Understanding workers’ compensation insurance

Workers’ compensation insurance, often referred to as workers’ comp, is a mandatory insurance policy designed to provide financial support to employees who suffer work-related injuries or illnesses. It serves as a safety net that ensures injured workers receive medical care and wage replacement, while also protecting employers from potential lawsuits.

Introduction

The importance of workers’ comp insurance b. Challenges faced by companies c. The secret to affordable coverage.

A small business owner sits down after a long day to purchase workers’ compensation coverage online. It’s 11:00 PM on a Tuesday, or maybe a Sunday evening. Either way, she won’t finally find time during normal business hours to cross the task off her to-do list.

Understanding workers’ comp insurance

Definition and purpose b. Legal requirements c. Benefits for employers and employees

Factors affecting workers’ comp premiums

Industry and risk classification b. Claims history and experience evaluation c. Employee payroll and classification

Strategies to reduce insurance premiums

Safety and training programs b. Effective claims management c. Return to work programmes.

The pain of workers compensation insurance

Workers’ compensation insurance can be a headache! It’s time consuming, expensive and frustrating. Let’s take a look at a few of the top complaints we hear from potential clients about how their workers are suffering!

- Rising Insurance Premiums: Small businesses often face the challenge of increasing workers’ compensation insurance premiums, which can strain already tight budgets.

- Complex Audits: The audit process associated with workers’ compensation insurance can be overwhelming and time-consuming. Small businesses may have difficulty gathering and submitting the necessary documentation, resulting in potential penalties or higher premiums.

- Limited Options: Many small businesses feel limited in their options when it comes to workers’ compensation insurance providers. Finding affordable options that still offer comprehensive coverage can be a challenge.

Other common pain points are large down payments and surprise audits that almost always result in unexpected large payments.

The best way to save on workers’ comp insurance

The best way to provide workers’ compensation insurance is to work with a local broker who ensures your employees’ classifications are correct. They can also help you shop for the best policy, as insurance companies often raise their rates over time.

If you’re looking for a provider that can help connect you with the best experts in workers’ compensation insurance, check out our list of the best payroll providers!

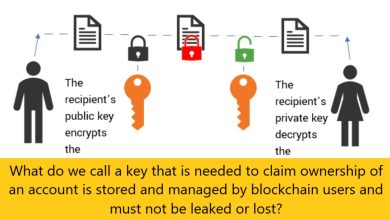

What is the difference between workers’ comp and disability insurance?

Although workers’ compensation insurance and disability insurance provide financial assistance to sick and injured workers who are unable to work, there are some key differences that separate the two policies.

Workers’ compensation insurance

Workers’ comp is a type of commercial insurance that pays for medical treatment for injured workers when they suffer a work-related injury or illness. Most states require businesses with employees to provide workers’ compensation benefits.

Disability insurance

In general, health insurance benefits individuals by helping them pay for medical care that is unrelated to their work. Disability insurance is a type of health insurance that helps pay for an individual’s lost income if they become disabled and unable to work.

The federal government does not require Americans to carry health insurance, although Washington, D.C., California, Massachusetts, New Jersey, Rhode Island, and Vermont do require individuals to carry health insurance or pay a tax penalty.

While short- and long-term disability insurance policies are also voluntary, some states, such as California, have state disability programs that offer mandatory coverage for all eligible employees.

What is Workers’ Compensation Insurance?

Workers’ comp insurance is a safety net that protects employees and employers in the event that a worker is injured or becomes ill as a result of the duties he or she performs on the job or in the course of the job. Workers’ compensation insurance benefits cover medical costs and lost wages for injured or sick employees.

Employers pay into a workers’ compensation fund, and if an employee is hurt, he or she is eligible for benefits from that fund.

Workers’ compensation insurance is a win-win. Injured employees can pay for the medical care they need, and will not suffer a loss of wages while they recover. Employers are not sued for the cost of medical expenses.

Workers’ comp does not cover employee injuries or illnesses that occur when an employee is not acting within the scope of work. An example of this might be a person who suffers an injury on their day off while helping a friend move, or a person who suffers a joint injury after work while exercising at the gym.

Conclusion

The path to affordable workers’ comp insurance b. Empowering businesses for a secure future

In today’s ever-changing business landscape, workers’ compensation insurance is not just a legal requirement, it is an important safety net for both employers and employees. However, high insurance premium costs can be a burden on many businesses, especially small ones. But fear not, as we delve into the world of workers’ comp insurance to uncover the secrets to securing affordable coverage without compromising protection. Workers comp insurance unveiling the secrets