4 problems of digital insurance in 2023

Kworld Trend / 4 problems of digital insurance in 2023, As digital becomes the new normal, what lies ahead, and what should insurance leaders prepare for? Here are 16 digital transformation trends.

4 problems of digital insurance in 2023

Today, we will take a loot at Digital insurance and the problems and benefits involved in this growing space in 2023.

The insurance industry is going through a digital transformation, which is changing the way insurers interact with their customers. The traditional model of insurance, where customers visit an insurance agent, fill out lengthy forms, and wait for weeks to get their policy, is slowly becoming a thing of the past. Today, digital insurance is gaining traction, and insurers are embracing technology to make the insurance experience more convenient, faster, and more personalized for customers.

Benefits of Digital Insurance

Convenience

Digital insurance has made insurance more convenient for customers. With digital insurance, customers can get a quote, purchase a policy, and file a claim from their phone or computer. This means that customers no longer have to wait in line to speak to an agent or fill out lengthy forms. Digital insurance also allows customers to access their policy information from anywhere, at any time, making it easier for them to manage their policies.

Personalization

Digital insurance has also allowed insurers to offer customers more personalized policies. Insurance companies can use data analytics to analyze customer behavior and preferences to create policies tailored to each customer’s needs. For example, a customer who drives less could be offered a lower premium, or a customer who lives in an area with a high crime rate could be offered a policy with more comprehensive coverage.

Speed

Digital insurance has also made the insurance process faster. With Digital Insurance, customers can get a quote and purchase a policy in minutes. Claims can also be filed and processed faster, as some insurance companies offer instant payments for certain types of claims. This means customers can get the coverage they need quickly, without having to wait for a long time.

Industry-wide transformation

The insurance industry has faced massive changes not only in the past few years, but also in the last decade or so. Historically low rates in the past 12 years have meant riskier investments for insurers, and companies have been tested further by a surge in claims in 2020-2021 due to the coronavirus pandemic. Furthermore, customer expectations are changing at a digital rate – and service providers are expected to continue to keep pace.

According to a recent study, 43 percent of customers will leave their current service provider if support or service becomes difficult to obtain (Accenture, 2017). Digital transformation can help insurers meet new customer expectations and needs by enhancing product development and offering channels, such as digital-first experiences and 24/7 support. In addition, digital capabilities can help achieve operational goals such as fraud prevention and aid integrated risk management (IRM) initiatives.

What is digital transformation anyway?

At its core, digital transformation is the process of using technology to create or improve new business processes, products, or services. This can be done through the use of new technologies, such as artificial intelligence (AI), big data, Internet of Things (IoT), and robotics.

The evolution of digital transformation in the insurance sector

One of the first examples of digital transformation in the insurance sector was the use of scanners and complex algorithms to price insurance premiums more accurately. This increased accuracy has increased the profitability of insurers, and has also allowed them to better manage risk. In the late 1990s, insurance companies began using the Internet to sell insurance products directly to consumers. This created a new source of revenue for insurance companies, and also helped increase customer loyalty and retention.

In recent years, insurance companies have used digital technology to drive more transformations in the way they operate. For example, insurance companies are now using data analytics to better understand customer needs and preferences, and to identify new opportunities for growth.

Digital insurance problems

But the road to becoming a digital business is fraught with difficulties, here are some of the difficulties insurance companies may face:

- Difficulty implementing a connected ecosystem : Insurers must focus on creating a connected ecosystem that can keep pace with the rapid changes that digital transformation demands, while still providing excellent experiences for customers, agents, employees, and other business partners. Consumers frequently view insurers as traditional organizations rich in heritage and knowledge but notoriously slow to embrace digital change. Therefore, it is necessary to devise digital solutions that connect users to each other and can also connect each user’s multiple touch points together, including emails, website content, mobile, IoT, physical locations, and more. Doing so enables insurers to stay competitive because they are able to deliver the cohesive experiences their users demand.

- Lack of digital speed: As the insurance market changes and digitalization increases, there is a need for insurance companies to become more agile and efficient in order to keep up with the exponential pace at which the industry is accelerating. It is not limited to one area of your company or just the products and services you offer but across the board. You can’t offer an agile experience when it comes to product purchase by offering flexible pricing software like pay-per-use, for example, and you also haven’t implemented digital flexibility into your claim processes or overall customer experience. In fact, the most effective digital transformations are those in which digital technology improves efficiency and is embedded throughout a company’s operations and organization—in both internal back-end operations and external, customer-facing portals. but,

- Disruption from InsurTech: Insurtechs are a growing threat to the insurance industry. Not only are they multiplying, they are also disrupting the industry through product development and delivery, adding to consumers’ ever-changing expectations for digital integration and experiences. Research shows that as digital continues to evolve, consumer expectations for digital experiences continue to rise as well and poor customer experience can be a deal breaker for new business.

In 2018 alone, global investment in InsurTech exceeded $2 billion. The global market is expected to grow at an annual growth rate of 41 percent from 2019 to 2023, disrupting the industry with product development and delivery, as well as consumers’ ever-changing expectations for digital integration and experiences. - Inoperable Systems : One of the biggest challenges is the lack of adaptability to future operating models. As new technologies and tools come to market, insurance companies have a hard time including or implementing them in their technology stack due to outdated, inoperable systems. 68% of insurers see outdated systems as the biggest obstacle to digital transformation. This lack of integration prevents future integration of any tools and systems, which prevents future success.

Challenges of digital transformation in insurance

The digital transformation of the insurance industry is well under way, as insurers embrace digital technologies to drive efficiency, improve customer engagement, and create new business opportunities. However, digital transformation is not without challenges, and insurance companies need to be aware of potential risks as they seek to digitalize their business.

Key challenges facing insurers in digital transformation include:

1) Data privacy and security

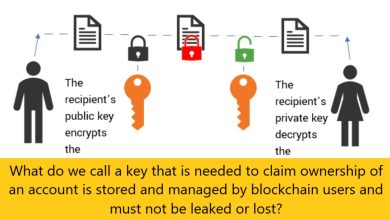

This is one of the major challenges as insurance companies keep large amounts of sensitive customer data. This data is increasingly stored in the cloud, which makes it more vulnerable to cyberattacks. In order to protect this data, insurance companies need to take strong security measures, such as data encryption and multi-factor authentication.

2) Infrastructure

In order to support digital transformations, companies need the right IT infrastructure and processes. This can be a significant investment for insurers, who need to ensure they have the right skills and capabilities within the company to meet their IT modernization goals.

3) Regulatory

The main challenge for insurance companies is the regulatory environment. Insurance is a highly regulated industry, and digital transformation can lead to changes that may conflict with existing regulations.

For example, the use of data analytics in price lock products may be seen as discriminatory if certain groups of people are charged higher premiums based on their data profiles. Insurance companies need to work closely with regulators to ensure that their digital transformations are in compliance with all relevant regulations.

4) Operational risk

Digital transformation can increase operational risk, as operations become more reliant on technology. Insurance companies need robust risk management processes to mitigate these risks.

Overall, digital transformation presents challenges and opportunities for insurers. While there are some risks that must be carefully managed, digital transformation provides an opportunity for insurers to increase efficiency, interact with customers in new ways, and create new sources of revenue.

Benefits of digital transformation in insurance

The insurance sector has been one of the most traditional and conservative industries for many years. However, digitalization is beginning to change, as insurance companies have begun to embrace new digital technologies in order to stay competitive.

There are a number of benefits that digital transformation can bring to the insurance industry. Digitization can help insurers better understand their customers through data analytics, which in turn can help them develop more personalized products and improve customer retention.