the pros of crypto regulation crypto.hostkiv.com

Kworld Trend / the pros of crypto regulation crypto.hostkiv.com

the pros of crypto regulation crypto.hostkiv.com

Cryptocurrencies were a warm subject matter for buyers and buyers in recent years. However, the shortage of law withinside the crypto marketplace has caused worries over fraud, marketplace manipulation, and cash laundering. Proponents of crypto law argue that it’s essential to guard buyers and make sure that the marketplace operates fairly. Here are a number of the capability blessings of law withinside the crypto marketplace:

1. Increased investor safety

One of the number one arguments in desire of crypto law is that it’d offer more safety for buyers. Regulatory bodies consisting of the SEC (Securities and Exchange Commission) and the FCA (Financial Conduct Authority) might have more oversight over the marketplace, making sure that agencies observe guidelines and that buyers aren’t taken advantage of. This might make the marketplace greater obvious and decrease the chance of fraud, which in flip might boost investor self belief.

2. Reduced marketplace volatility

One of the criticisms of the crypto marketplace is that it’s far rather volatile, with expenses fluctuating swiftly in reaction to marketplace information and speculation. The loss of law has been a contributing component to this volatility, because the marketplace is vulnerable to manipulation and insider trading. With more law, the marketplace might be greater solid, as manipulative practices might be curtailed and investor self belief might be improved. This might cause a greater mature marketplace, with much less wild swings in expenses.

3. Greater mainstream adoption

Crypto law might additionally assist to boom mainstream adoption of cryptocurrencies. Many conventional monetary establishments are hesitant to make investments withinside the crypto marketplace because of the shortage of law, which they see as a chance to their recognition and monetary stability. With more law, those establishments might be much more likely to make investments withinside the marketplace, which might boom liquidity and in the end cause more adoption of cryptocurrencies.

The Cons of Crypto Regulation

While there are compelling arguments in favor of crypto law, there also are worries that law should stifle innovation and damage the decentralization that is on the coronary heart of cryptocurrencies. Here are a number of the capability drawbacks of improved law withinside the crypto marketplace:

1. Reduced innovation

One of the important blessings of the decentralized nature of cryptocurrencies is that it permits innovation and experimentation. With more law, however, there’s a chance that this innovation may be stifled. Companies can be much less inclined to take risks and expand new technology if they’re problem to strict regulatory oversight. This should cause a much less dynamic marketplace, with fewer new thoughts and less possibilities for growth.

2. Increased fees

Crypto law might additionally come at a cost. Companies might want to put money into compliance measures and regulatory oversight, which might boom their fees and doubtlessly lessen their profits. This should make it tougher for smaller agencies to compete with inside the marketplace, as they’ll now no longer have the assets to conform with regulatory requirements.

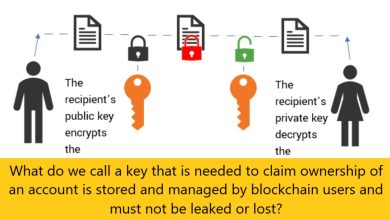

3. Reduced privateness and anonymity

Another capability downside of crypto law is that it may lessen the privacy and anonymity that is presently loved through customers of cryptocurrencies. Many cryptocurrencies are designed to be anonymous, permitting customers to make transactions without revealing their identities. With more law, this anonymity may be compromised, as regulatory bodies might require more transparency and oversight of transactions. This may be a difficulty for customers who price their privateness and anonymity.

The Effect of Regulation at the Crypto Market | the pros of crypto regulation crypto.hostkiv.com

The effect of law at the crypto marketplace is a topic of plenty debate. Some argue that law might be beneficial, at the same time as others trust that it’d be detrimental. Here are a number of the capability consequences of law at the marketplace:

1. Price volatility

One of the maximum instantaneous consequences of law at the crypto marketplace might be improved fee volatility. As our bodies start to enforce new guidelines, the marketplace might probably enjoy fluctuations in fee as buyers react to the brand new rules. However, over the lengthy term, more law should cause a greater solid marketplace, with much less volatility.

2. Increased adoption

Crypto law can also cause accelerated adoption of cryptocurrencies. As conventional economic establishments start to make investments withinside the marketplace, liquidity could increase, making it less complicated for people and companies to apply cryptocurrencies for transactions. This ought to cause extra mainstream adoption of cryptocurrencies, which could be a high quality improvement for the marketplace.

3. Consolidation

Another capability impact of law at the crypto marketplace is consolidation. With extra regulatory oversight, smaller corporations can also additionally war to compete with larger, greater installed companies which have the assets to conform with regulatory requirements. This ought to cause a marketplace ruled via way of means of some big players, which can be a challenge for individuals who price decentralization and competition.

Crypto regulation for exchanges

The Financial Crimes Enforcement Network (FinCEN) regards crypto exchanges as money transmitters since crypto tokens are “other value that substitutes for currency.” Like traditional money transmitters, they fall under the scope of the Bank Secrecy Act (BSA). This entails mandatory FinCEN registration, an AML/CFT program, reporting requirements, and compliance with the “Travel Rule” by collecting and sharing data on the originators and beneficiaries of transactions.

Clash of approaches: the SEC vs. the CFTC

To the US Securities and Exchange Commission (SEC), cryptocurrencies are securities, so securities laws should apply to digital wallets and exchanges. Chairman Gary Gensler has famously compared crypto to the Wild West. “Nothing about the crypto markets is incompatible with the securities law,” he said, noting that investor protection was just as relevant for blockchain technology.

However, the Commodities Futures Trading Commission (CFTC) treats Bitcoin as a commodity. It allows public crypto derivatives trading and follows a “do no harm” approach. The outcome of this debate over who regulates cryptocurrency should influence any new crypto regulations in the country.

Reasons to regulate cryptocurrency as securities

The Dependable Monetary Advancement Act, presented in June 2022, treats digital forms of money that breeze through the Howey Assessment as protections. The test, named after the 1946 US High Legal dispute, incorporates three inquiries and requires three positive solutions to characterize a resource as a security:

- Is there an investment of money with the expectation of future profits?

- Is there an investment of money in a common enterprise?

- Do any profits come from the efforts of a promoter or third party?

Assuming the Demonstration becomes regulation, guarantors should follow the SEC’s enrollment and announcing rules or suffer significant consequences for neglecting to do as such. Besides, William A. Powers, Nossaman LLP, focuses to an agreement about treating cryptos as protections when they are traded by individuals from Congress.

During starting coin contributions, digital forms of money are given in much the same way to stock. These raising money attempts for blockchain and crypto-related firms look like beginning public contributions, or Initial public offerings, in TradFi. Holders of the tokens get close enough to the task and its likely benefits.

Moreover, yield cultivating — a type of the crypto loaning market — is similar to obligation protections. Crypto banks acquire revenue or charges, like offer loaning in the financial exchange. This training permits crypto organizations, like excavators for installment processors, to get to credit extensions.

Pros and cons

On the off chance that the subsequent regulation mirrors the perspective on the SEC, crypto guideline will involve more tough oversight. All things considered, gave the market passes every one of the administrative obstacles, it will draw in a more extensive pool of financial backers, including those leaning toward stocks and other ordinary public protections.

Jai Messari, prime supporter and CLO of Lightspark and the meeting instructor at Berkeley Regulation, suggests the methodology from The Ineluctable Methodology of Protections Regulation: Why Fungible Crypto Resources Are Not Protections. As indicated by the paper, trading crypto are not protections exchanges, while capital-raising undertakings as are ICOs.

In the mean time, the SEC’s methodology depends on whether the venture behind a given crypto resource is “adequately decentralized” anytime. Messari refers to this hypothesis as “unrealistic — on the off chance that not difficult to apply — in the present genuine blockchain projects.”

Future of US crypto regulations

The Biden organization is currently centered around fighting unlawful exchanges, especially considering the 2022 Land breakdown and the FTX disaster, which uncovered $5 billion missing from the organization’s accounting report. The Chief Request on Guaranteeing Mindful Improvement of Advanced Resources illustrated the first “entire of-government” guide to crypto regulation. It incorporates five different needs:

- Protecting investors and consumers

- Promoting financial stability

- Supporting the country’s financial leadership and economic competitiveness

- Financial inclusion

- Responsible innovation

As per the arrangement, the US Depository is expected to play out an “unlawful money risk evaluation on decentralized finance” toward the finish of February 2023 and “an appraisal on non-fungible tokens by July 2023.” The organization likewise means to feature the country’s authority in the field of CBDCs (National Bank Advanced Monetary standards), guaranteeing any future US government digital currency “is steady with US needs, and majority rule values.”

The crypto neighborhood guess that the We experts ought to fix the screws after a short time. The SEC made the chief move toward this way in 2020 when it sued Wave Labs for evidently selling the XRP token as an unregistered security.

At press time, a court administering, possibly critical for deciding whether cryptos can be viewed as protections, is normal at some point in 2023.

The unexpected benefits of cryptocurrency regulation

Sir Winston Churchill is credited with saying “never let a good crisis go to waste,” indicating that even in times of duress, a silver lining exists. One could then argue that the recent cryptocurrency crash, which caused so many retail investors to lose substantial parts of their digital asset portfolios, resulted in a silver lining indeed – the regulation of the crypto market in the hopes of preventing a similar catastrophe from happening again.

A silver lining or a red herring?

Is regulation a silver lining? How is regulating the one thing that was never intended to be controlled by governments a positive?

Yes, I can fully understand how crypto adepts (of which I consider myself to be one) would strongly oppose the notion of attempting to bring the so-called economy by the people, for the people under the helm of a regulator. This is the same regulator that arguably made such a mess before, which was why Satoshi Nakamoto felt it necessary to create Bitcoin.

So why do I consider this a silver lining? Because it just might be what we need to withstand the current market volatility. At the moment, people are losing a lot of money in crypto, and the market would benefit from a bit of stability. Hopefully, most investors have been smart enough to only invest what they can afford to lose, but when the urgency is high and the rewards are enticing, people tend to take reckless decisions – especially in badly performing or unstable economies.

Advantages of Regulating the Crypto Markets

1. Reducing Scams

The crypto market is making lots of people wealthy, no doubt about that. Unfortunately, people are losing millions too, through scam coins and ICOs. Due to the unregulated nature of this market, scammers have invaded it by launching all sorts of scam coins. These coins are pumped into the market, and once investors put in money, the project owners disappear, taking that money along with them. Investors are left holding worthless tokens that are later delisted by exchanges. That is, if they ever make it onto an exchange in the first plact.

On this front, cryptocurrency regulation worldwide could do a great favor to the market. Regulations would help ensure that every new coin coming to the market meets certain criteria. This way, people putting money into cryptos feel safer with their investments.

2. Attracting Institutional Money Into the Markets

Assume just for a minute that you are a mutual fund manager controlling billions of dollars. In investor-funds, most of it pension money. Would you put it in cryptos?

However, There is a good chance that your answer is NO! The same answer will come up to the question. Moreover, “Is bitcoin legal or not?” That’s because this is an unregulated market where all your money. Which can vanish in an instant with no recourse. Moreover, maybe even earning yourself a few hundred years in jail for negligence when handling investor capital.

However, if the market were regulated with clear operational structures in place, institutional investors would pour billions of dollars into cryptos. Liquidity levels would increase making the market more efficient for traders. However, Huge price differentials between exchanges that exist today would cease to exist.

3. Giving the Crypto Market Moral Legitimacy

Let’s face it, for quite some time, a lot of representatives of the modern cryptocommunity are sure that bitcoin is the coin for criminals. It was thought to be a currency for buying drugs, sex trafficking and other crimes that take place on the dark web. This image only started fading away after the price of bitcoin shot up in 2017. Unfortunately, this kind of thinking still takes place. That’s why countries keep threatening to take stern action against cryptos.

For example, crypto regulation in India has recently reached its apogee. China, too, seems to be on an aggressive war against them in the belief that they are a threat to the financial system. This negative tag can easily disappear with bitcoin regulation. However, If there were a global regulatory framework guiding this market, no country would find the need to ban them. In fact, they would be encouraged as an alternative investment.

Disadvantages of Cryptocurrency Regulation

1. It Poses the Risk of Capital Flight From Cryptos

Of course, there are some cryptocurrency regulation problems. To understand this, you need to ask yourself, why are cryptos so popular in the first place? It’s simple! However, they are popular because of the desire for people to take charge of their lives, away from centralized government systems. Therefore, by introducing government regulations, it would be like bringing in government – the same entity that crypto heads don’t want snooping over their money, into the system. The result would be a flight to traditional investments, since they are more stable. There would be no point in placing money in a risky asset, whose ideological objective is no longer clear.

Such capital flight is not imagination. Just look at how the market has been behaving since the Far East countries started talking regulation. Moreover, The market tanked, with bitcoin falling by over 50%. Imagine what would happen if regulations were to go global? The future of cryptocurrency would drop so drastically that it would be a shadow of its former self.

Verdict

It is quite clear that the advantages of regulating the crypto market clearly outweigh the cons. In fact, as things stand, this is a market screaming for regulation. It’s only through cryptocurrency regulation that you will be able to leave your money in an exchange without fear. However, Cryptocurrency regulation challenges are not that big. That’s because the people putting money into cryptos right now don’t have much attachment to the whole ideology of cryptos and power to the people. They are just looking to invest and grow their wealth, and regulation to them is a form of capital protection.